Personal Alarms

A Closer Look at Keysafes

Josh

Updated on

5 New Year's Resolutions for Older People

Josh

Updated on

A Guide to Winter Illnesses

Paul Henshall

Updated on

Personal Alarms for the Elderly Can Help the NHS

Thom

Updated on

Neighbours' Building Work: Your Right to Object

'@Lifeline24

Updated on

Technology

How Over-60s Can Cut Costs by Exploring Renewable Energy

'@Lifeline24

Updated on

8 Top Apps for Older People

Josh

Updated on

Mobile Phones for Older People

Josh

Updated on

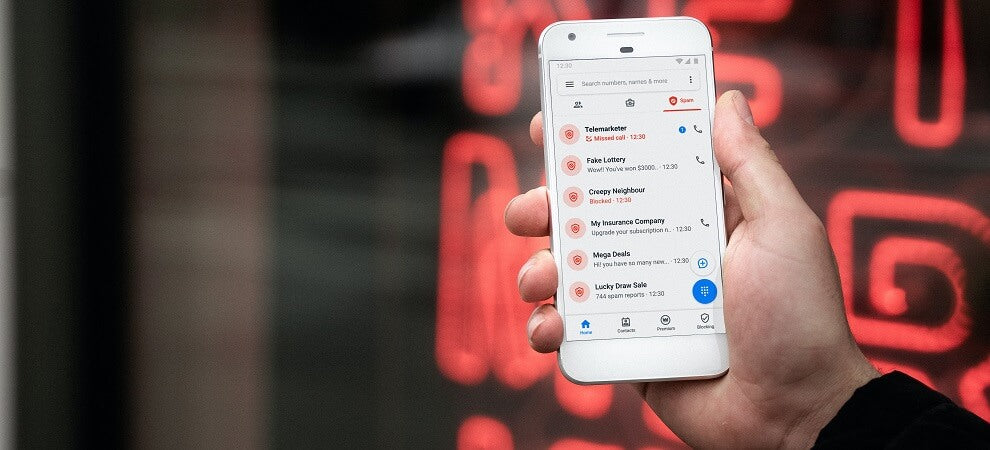

Telephone Scams in 2024: Don't Be a Victim

Josh

Updated on

Social Media for Older People: A Helpful Guide

katie.smith@lifeline24.co.uk

Updated on

What Are the Benefits of a Smartwatch?

katie.smith@lifeline24.co.uk

Updated on

Health & Fitness

7 Sport and Fitness Activities for Older People

katie.smith@lifeline24.co.uk

Updated on

5 Exercises to Improve Your Balance

katie.smith@lifeline24.co.uk

Updated on

How to Commit to a Healthy Exercise Regime in Later Life

'@Lifeline24

Updated on

Wild Swimming: The Benefits for Older People

katie.smith@lifeline24.co.uk

Updated on

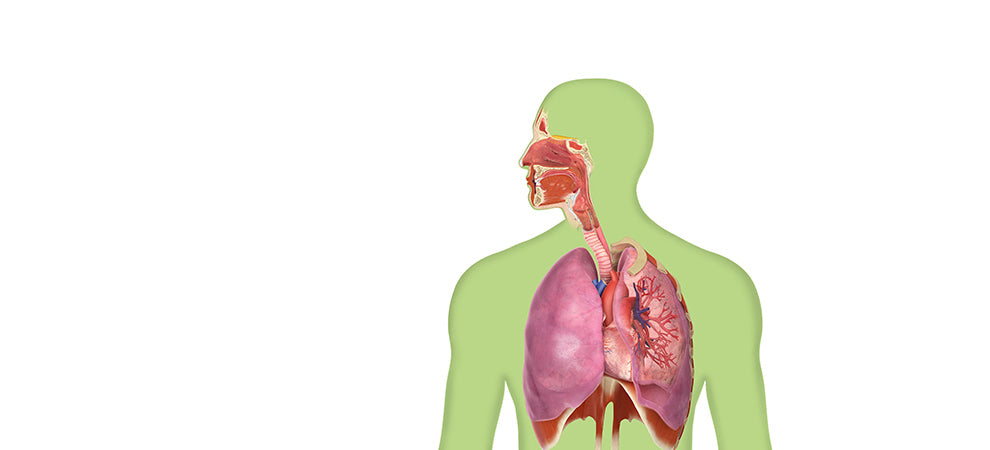

A Guide to the Different Types of Lung Disease

Paul Henshall

Updated on

Best Aids for Walking: Staying Mobile in Later Life

'@Lifeline24

Updated on

Finances

10 Great Freebies & Discounts for Over-60s

Josh

Updated on

Pensions: Everything You Need to Know

Josh

Updated on

Funeral Costs - A Useful Guide

Josh

Updated on

Benefits for Pensioners That You Should Be Receiving

katie.smith@lifeline24.co.uk

Updated on

How to Avoid Phishing and Scams

'@Lifeline24

Updated on

Personal Independence Payment: Everything You Need to Know

'@Lifeline24

Updated on

Seasonal

How to Keep Warm This Winter

Josh

Updated on

Winter Cities: We Look At The Top 5 To Visit This Year

James Connolly

Updated on

Best Ways to Prepare for the Summer Season

'@Lifeline24

Updated on

Father's Day Gift Ideas

Josh

Updated on

History of Daylight Savings: Why Do the Clocks Go Forward?

katie.smith@lifeline24.co.uk

Updated on

A Guide to St Patrick's Day

Josh

Updated on

Hobbies

Creative Writing and Its Cognitive Benefits

'@Lifeline24

Updated on

5 Benefits of Older People Having Pets

Josh

Updated on

Benefits of Learning a Foreign Language: It's Never Too Late

katie.smith@lifeline24.co.uk

Updated on

Top 8 Flowers to Grow this Summer

Josh

Updated on

Why You Should Read More Now You're Retired

'@Lifeline24

Updated on

Amazing Health Benefits of Gardening for Pensioners

Diana

Updated on

Medical Conditions

Shingles: A Useful Guide

Josh

Updated on

Advances in Cancer Treatments in 2023

'@Lifeline24

Updated on

Strokes: A Useful Guide

Josh

Updated on

Symptoms of a Heart Attack

Josh

Updated on

Chronic Kidney Disease: A Useful Guide

Josh

Updated on

A Guide to the Different Types of Dementia

katie.smith@lifeline24.co.uk

Updated on

Staying Safe

Travel Tips for Elderly Holidaymakers with Limited Mobility or a Disability

Julia Hammond

Updated on

5 Ways of Avoiding a Staircase Accident

Josh

Updated on

5 Ways to Improve Fire Safety at Home

Josh

Updated on

5 Ways to Improve Your Electrical Safety

Josh

Updated on

5 Ways of Staying Safe in the Bathroom

Josh

Updated on

Staying Safe at Home: 11 Top Tips for Older People

Thom

Updated on

Family

Accessible Holidays: Booking A Disability Friendly Getaway

elena.koefman

Updated on

Grief Counselling: The Importance of Discussing Loss

katie.smith@lifeline24.co.uk

Updated on

5 Things To Do After Your Parent Has a Stroke

katie.smith@lifeline24.co.uk

Updated on

Six Activities to Entertain the Grandkids

katie.smith@lifeline24.co.uk

Updated on

Christmas Activities: Fun Things To Do With Your Grandchildren

James Connolly

Updated on

Easter 2023 - 5 Activities To Do With Your Grandchildren

roshan.harvey

Updated on